Table of Contents

Toggle- Strategic Crypto Investing for Boomers

- Advantages of Strategic Crypto Investing for Boomers

- Overcoming Barriers to Cryptocurrency Adoption

- Tips for Strategic Crypto Investing for Boomers

- Risks of Strategic Crypto Investing for Boomers

- Benefits of Strategic Crypto Investing for Boomers

- Conclusion

- Ready to Start Strategic Crypto Investing?

- Frequently Asked Questions

- Who should consider strategic crypto investing?

- What are the benefits of strategic crypto investing for boomers?

- How can I get started with strategic crypto investing?

- What are the risks of strategic crypto investing?

- Who can help me make informed crypto investment decisions?

- What if I'm confused or skeptical about crypto investing?

Strategic Crypto Investing for Boomers

Cryptocurrency investing has emerged as a popular alternative investment option over the last few years. Strategic crypto investing for boomers can provide numerous benefits such as high potential returns, diversification of portfolio, hedge against inflation, and control over investments. As per Finance Strategists, Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. It has been around for over a decade, and despite the initial skepticism and regulatory hurdles, the market has grown to over $2 trillion.

A Brief History of Cryptocurrency

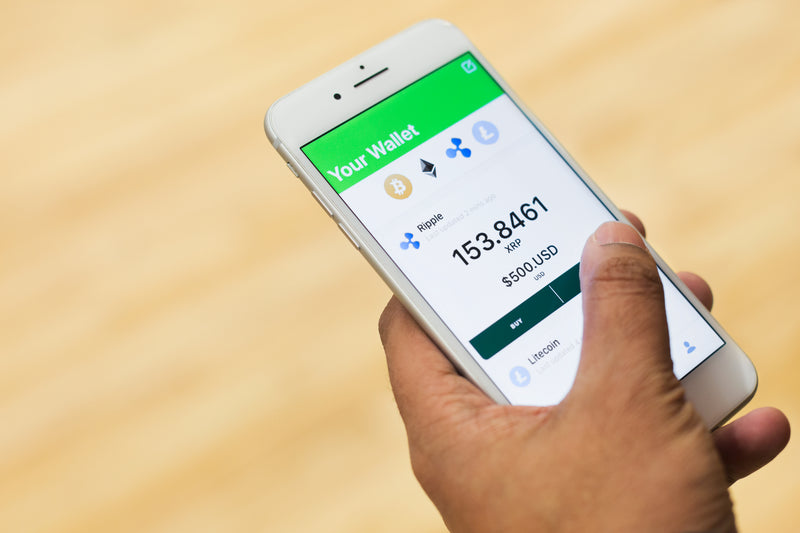

Cryptocurrency was created in 2009 with the invention of Bitcoin by an unknown person or group of people under the name Satoshi Nakamoto. It is based on blockchain technology, a decentralized ledger that records transactions across a network of computers. Since then, several cryptocurrencies have emerged, such as Ethereum, Ripple, and Litecoin. Cryptocurrency gained popularity due to its decentralized nature, anonymity, and security features. It has also led to the development of various blockchain-based applications, such as smart contracts and decentralized finance (DeFi).

Why Strategic Crypto Investing is Important for Boomers

As per Finance Strategists, digital assets are becoming increasingly important in retirement planning as more people accumulate valuable online assets such as cryptocurrency, social media accounts, and digital media. Baby boomers, who are approaching retirement age, need to consider various investment options to secure their financial future. Cryptocurrency investing can provide a high potential return on investment and diversify their portfolio. Additionally, cryptocurrency can be used as a hedge against inflation, which can erode the value of traditional investments such as stocks and bonds. It also gives boomers more control over their investments and allows them to invest in a new and exciting asset class.

Advantages of Strategic Crypto Investing for Boomers

Strategic crypto investing for boomers can offer several advantages over traditional investments. Here are some of them:

High Potential Returns

One of the most significant advantages of crypto investing is the potential for high returns. According to Finance Strategists, cryptocurrency investments can be a high-risk, high-reward opportunity for investors looking to diversify their portfolios. The market has seen significant growth over the years, and some cryptocurrencies have provided returns of over 10,000% in a few years. However, it is essential to note that the market is highly volatile, and there is a risk of losing money.

Diversification of Portfolio

Diversification is a crucial aspect of investing, and cryptocurrency can provide an alternative asset class to traditional investments such as stocks and bonds. As per Investopedia, many investors across all age groups believe that cryptocurrencies are too risky for their portfolios. However, strategic crypto investing can provide diversification and reduce the risk of an investment portfolio.

Hedge against Inflation

Inflation is a concern for many investors, and traditional investments may not provide adequate protection against it. Cryptocurrency, on the other hand, can be used as a hedge against inflation. According to Finance Strategists, cryptocurrency is not tied to any central bank or government and is not subject to the same inflationary pressures as traditional currencies.

Control over Investments

Another advantage of strategic crypto investing is that it gives investors more control over their investments. Investors can choose which cryptocurrencies to invest in, how much to invest, and when to sell. This level of control can help investors make more informed decisions and reduce the risk of losses.

Overcoming Barriers to Cryptocurrency Adoption

Cryptocurrency adoption faces several barriers, and many potential investors are hesitant to invest in this new asset class. However, there are solutions to overcome these barriers. Here are some of the most common barriers and how to overcome them:

Confusion and Lack of Knowledge

Cryptocurrency can be a confusing and complex subject for many people, and lack of knowledge can be a significant barrier to adoption. However, there are several ways to overcome this barrier:

-

Research: Investors can research the basics of cryptocurrency, such as how it works, what blockchain is, and the different types of cryptocurrencies available. Finance Strategists provides a comprehensive guide to cryptocurrency investing.

-

Education: Investors can take courses or attend seminars to learn more about cryptocurrency. Many online platforms offer free or low-cost courses on cryptocurrency investing.

-

Professional Advice: Investors can seek professional advice from financial advisors or cryptocurrency experts to get a better understanding of the market and the risks involved.

Perception of High Risk

Cryptocurrency is often perceived as a high-risk investment due to its volatility and lack of regulation. However, there are ways to mitigate the risks and make informed investment decisions:

-

Due Diligence: Investors should do their due diligence before investing in any cryptocurrency. This includes researching the project, the team behind it, and the market trends. Cointelegraph suggests that boomers spend more time doing due diligence on projects and focus on technical factors, while younger investors prioritize reputational elements.

-

Diversification: Investors should diversify their cryptocurrency portfolio to reduce the risk of losses. They can invest in multiple cryptocurrencies or spread their investment across different asset classes.

-

Long-Term Approach: Cryptocurrency is a long-term investment, and investors should not expect immediate returns. They should take a long-term approach and hold their investments for a few years to see significant returns.

Solutions to Overcome Barriers

The barriers to cryptocurrency adoption can be overcome by using the following solutions:

-

Education: Investors can educate themselves about cryptocurrency to gain a better understanding of the market and the risks involved.

-

Professional Advice: Investors can seek professional advice from financial advisors or cryptocurrency experts to make informed decisions.

-

Regulation: As the cryptocurrency market matures, regulation is expected to increase, which can help reduce the risk of scams and fraud.

-

Adoption: As more people adopt cryptocurrency, it will become more mainstream and less risky.

Tips for Strategic Crypto Investing for Boomers

Strategic crypto investing requires careful planning and research. Here are some tips for boomers looking to invest in cryptocurrency:

Start Small

Cryptocurrency investing can be risky, and it is essential to start small and invest only what you can afford to lose. As per Investopedia, baby boomers are highly unlikely to invest in digital currencies, with just 6% investing in cryptocurrencies. However, starting small and gradually increasing the investment can help reduce the risk.

Choose the Right Exchange

Choosing the right cryptocurrency exchange is crucial for successful investing. Investors should consider factors such as security, fees, and reputation when choosing an exchange. Finance Strategists recommends using reputable and regulated exchanges such as Coinbase, Kraken, and Binance.

Diversify Cryptocurrency Portfolio

Diversification is key to successful investing, and it is recommended to diversify the cryptocurrency portfolio. Investors can invest in multiple cryptocurrencies or spread their investment across different asset classes such as stocks, bonds, and real estate.

Consider Long-Term Approach

Cryptocurrency is a long-term investment, and investors should take a long-term approach. It is important to hold the investments for a few years to see significant returns. Trying to time the market can be risky and result in losses.

Do Due Diligence

Doing due diligence is crucial before investing in any cryptocurrency. Investors should research the project, the team behind it, and the market trends. They should also consider factors such as the technology, adoption rate, and competition.

Stay Informed

The cryptocurrency market is constantly evolving, and it is essential to stay informed about the latest trends and developments. Investors can stay informed by reading news articles, following social media accounts of cryptocurrency experts, and attending cryptocurrency conferences and events.

Seek Professional Advice

Investors can seek professional advice from financial advisors or cryptocurrency experts to make informed decisions. They can provide guidance on the market trends, risk management, and investment strategies.

Risks of Strategic Crypto Investing for Boomers

While strategic crypto investing can offer high potential returns, there are also risks involved. Here are some of the most common risks of crypto investing:

Volatility

The cryptocurrency market is highly volatile and can experience significant price fluctuations in a short period. As per Finance Strategists, the market is influenced by several factors such as government regulations, adoption rate, and investor sentiment. Investors should be prepared for sudden price drops and be patient during market downturns.

Lack of Regulation

Cryptocurrency is not regulated by any central authority, and this lack of regulation can increase the risk of scams and fraud. As per Investopedia, confusion and perceptions of high risk remain a hurdle for further cryptocurrency adoption. Investors should be cautious and do their due diligence before investing in any cryptocurrency.

Cybersecurity Threats

The cryptocurrency market is susceptible to cybersecurity threats such as hacking and theft. Investors should take measures to protect their investments, such as using secure wallets, two-factor authentication, and avoiding public Wi-Fi networks.

Market Saturation

The cryptocurrency market is becoming increasingly saturated, with thousands of cryptocurrencies available. It can be challenging to choose the right cryptocurrency to invest in, and investors should do their due diligence and diversify their portfolio.

Lack of Liquidity

Some cryptocurrencies may lack liquidity, which can make it challenging to sell them during market downturns. Investors should choose cryptocurrencies with high trading volume and liquidity.

Tax Implications

Cryptocurrency investing can have tax implications, and investors should be aware of the tax laws in their country. Cryptocurrency gains may be taxable as capital gains or income, depending on the holding period and the amount of gain.

Overcoming Risks

Investors can overcome the risks of strategic crypto investing by:

- Doing due diligence before investing in any cryptocurrency

- Diversifying their cryptocurrency portfolio

- Using reputable and regulated cryptocurrency exchanges

- Protecting their investments with secure wallets and two-factor authentication

- Staying informed about the latest market trends and developments

- Seeking professional advice from financial advisors or cryptocurrency experts.

Benefits of Strategic Crypto Investing for Boomers

Strategic crypto investing can offer several benefits to boomers, including:

High Potential Returns

Cryptocurrency investing can offer high potential returns, and some cryptocurrencies have seen significant price increases in recent years. For example, Bitcoin has seen a 200% increase in value from 2020 to 2021. However, investors should be prepared for market volatility and do their due diligence before investing in any cryptocurrency.

Portfolio Diversification

Cryptocurrency can be an effective way to diversify an investment portfolio. Cryptocurrency is not correlated with traditional asset classes such as stocks and bonds, and its price movements are independent of the broader market trends.

Hedge Against Inflation

Cryptocurrency can be a hedge against inflation, as it is not subject to government monetary policies and regulations. As per Finance Strategists, cryptocurrency can also serve as a safe-haven asset during times of economic uncertainty.

Opportunities for Passive Income

Cryptocurrency can offer opportunities for passive income through staking, mining, and lending. Investors can earn cryptocurrency by staking their holdings, which involves holding the cryptocurrency in a wallet and supporting the network's operations. Mining involves solving complex mathematical problems to validate transactions and earn cryptocurrency rewards. Lending involves lending cryptocurrency to other users and earning interest on the loan.

Accessibility and Low Barriers to Entry

Cryptocurrency investing is accessible to anyone with an internet connection and a smartphone or computer. The barriers to entry are low, and investors can start with small amounts of money. As per Finance Strategists, many cryptocurrency exchanges also offer low fees and user-friendly interfaces.

Overcoming Barriers to Adoption

Cryptocurrency adoption faces several barriers, and boomers can help overcome these barriers by adopting cryptocurrency. As per Finance Strategists, digital assets are becoming increasingly important in retirement planning as more people accumulate valuable online assets such as cryptocurrency, social media accounts, and digital media.

Final Thoughts

Strategic crypto investing can offer several benefits to boomers, including high potential returns, portfolio diversification, hedge against inflation, opportunities for passive income, accessibility, and low barriers to entry. However, investors should be aware of the risks involved and do their due diligence before investing in any cryptocurrency. Seeking professional advice from financial advisors or cryptocurrency experts can also help make informed investment decisions.

Conclusion

Strategic crypto investing can be a high-risk, high-reward opportunity for boomers looking to diversify their portfolios and hedge against inflation. Cryptocurrency can offer several benefits, including high potential returns, portfolio diversification, opportunities for passive income, and low barriers to entry.

However, there are also risks involved, such as market volatility, lack of regulation, cybersecurity threats, market saturation, lack of liquidity, and tax implications. Investors should be prepared for these risks and do their due diligence before investing in any cryptocurrency.

Seeking professional advice from financial advisors or cryptocurrency experts can also help make informed investment decisions. By adopting cryptocurrency, boomers can help overcome the barriers to adoption and benefit from the growing importance of digital assets in retirement planning.

Overall, strategic crypto investing can be a viable option for boomers looking to diversify their portfolios and invest in the future of finance. With careful planning and research, investors can navigate the risks and reap the rewards of this emerging asset class.

Ready to Start Strategic Crypto Investing?

If you're ready to start strategic crypto investing, there are several steps you can take to get started:

Step 1: Educate Yourself

Before investing in any cryptocurrency, it's essential to educate yourself on the basics of cryptocurrency and blockchain technology. You can start by reading articles, watching videos, and listening to podcasts on cryptocurrency.

Step 2: Choose a Cryptocurrency Exchange

Choosing a reputable and regulated cryptocurrency exchange is crucial for the security of your investments. You can research different cryptocurrency exchanges, compare their fees and features, and choose the one that best suits your needs.

Step 3: Create a Cryptocurrency Wallet

A cryptocurrency wallet is a digital wallet that stores your cryptocurrency holdings. You can choose from various types of wallets, such as hardware wallets, software wallets, and paper wallets. It's essential to choose a secure wallet and protect it with strong passwords and two-factor authentication.

Step 4: Start Investing

Once you've done your research and chosen a cryptocurrency exchange and wallet, you can start investing in cryptocurrency. It's essential to diversify your portfolio and invest only what you can afford to lose.

Check out our website ccryptoinvestingforboomers.com for more great content on strategic crypto investing for boomers. Our website offers tips, guides, and expert advice on cryptocurrency investing and retirement planning.

Frequently Asked Questions

Who should consider strategic crypto investing?

Boomers looking to diversify their portfolios and hedge against inflation.

What are the benefits of strategic crypto investing for boomers?

High potential returns, portfolio diversification, and opportunities for passive income.

How can I get started with strategic crypto investing?

Educate yourself, choose a reputable exchange, create a secure wallet, and invest wisely.

What are the risks of strategic crypto investing?

Market volatility, lack of regulation, cybersecurity threats, and tax implications.

Who can help me make informed crypto investment decisions?

Financial advisors and cryptocurrency experts can provide professional advice.

What if I'm confused or skeptical about crypto investing?

Start with small investments, do your research, and seek professional advice if needed.