Table of Contents

Toggle- Why Profitable Crypto Investing is the Key to Financial Freedom for Boomers

- Understanding Cryptocurrency Investing

- Why Boomers are Better at Crypto Investing Than Millennials

- Top Cryptocurrencies to Invest in for Boomers

- How to Invest in Cryptocurrencies

- Risks of Investing in Cryptocurrencies

- Wrapping Up

- Questions and Answers

- Q. Who can invest in cryptocurrencies?

- Q. What are some benefits of investing in cryptocurrencies?

- Q. How do I choose which cryptocurrencies to invest in?

- Q. What are some risks associated with investing in cryptocurrencies?

- Q. How do I secure my cryptocurrency investments?

- Q. What if I'm not comfortable investing in cryptocurrencies?

Why Profitable Crypto Investing is the Key to Financial Freedom for Boomers

Cryptocurrency investments have become a popular choice for investors looking to diversify their portfolios. As more people accumulate valuable online assets, such as cryptocurrency, social media accounts, and digital media, digital assets are becoming increasingly important in retirement planning. For boomers, investing in cryptocurrencies can be an excellent way to create long-term wealth and financial security.

Benefits of Investing in Cryptocurrencies

Investing in cryptocurrencies comes with several benefits, including:

- High returns: Cryptocurrencies have the potential to generate high returns, with some cryptocurrencies increasing in value by thousands of percent in just a few years.

- Diversification: Cryptocurrencies can be an excellent way to diversify your investment portfolio, reducing the risk of losses.

- Security: Cryptocurrencies use advanced encryption techniques to secure transactions and protect investors from fraud and theft.

- Low fees: Cryptocurrency transactions typically come with lower fees than traditional financial transactions, saving investors money.

In the following sections, we will explore what cryptocurrency is, why boomers are better at investing in cryptocurrencies than millennials, the best cryptocurrencies to invest in for 2023, how boomers can start investing in cryptocurrencies, and case studies of boomers who have made profits from crypto investing.

Understanding Cryptocurrency Investing

According to financestrategists.com, cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Cryptocurrencies are decentralized and use blockchain technology to ensure that transactions are secure, transparent, and immutable.

How Cryptocurrency Works

Cryptocurrencies work using a decentralized system, meaning that they operate independently of a central authority, such as a bank or government. Instead, cryptocurrencies use blockchain technology, which is a decentralized ledger system that records transactions across a network of computers.

When someone makes a transaction using a cryptocurrency, that transaction is verified by a network of computers and added to the blockchain ledger. The ledger is then updated and stored on all computers in the network, making it highly secure and virtually impossible to alter or hack.

Advantages of Investing in Cryptocurrencies

Investing in cryptocurrencies comes with several advantages, according to financestrategists.com, including:

- Potential high returns: Some cryptocurrencies have experienced massive growth in value over the past few years, offering investors the potential for significant returns.

- Diversification: Cryptocurrencies can be an excellent way to diversify your investment portfolio, reducing the risk of losses.

- Transparency: Blockchain technology ensures that all transactions are transparent and immutable, making it easier to track and audit transactions.

- Security: Cryptocurrencies use advanced encryption techniques to secure transactions and protect investors from fraud and theft.

Risks of Investing in Cryptocurrencies

Investing in cryptocurrencies also comes with several risks, according to financestrategists.com, including:

- Volatility: Cryptocurrencies are highly volatile, with prices fluctuating rapidly and unpredictably.

- Lack of regulation: Cryptocurrencies are largely unregulated, meaning that there are few safeguards in place to protect investors.

- Hacking and theft: Cryptocurrencies can be vulnerable to hacking and theft, as they are stored online and can be accessed remotely.

Despite these risks, many investors see cryptocurrencies as a promising investment opportunity, particularly for those looking to diversify their portfolios and generate long-term wealth.

Why Boomers are Better at Crypto Investing Than Millennials

According to cointelegraph.com, new research by Bybit and Toluna shows that baby boomers are better at investing in cryptocurrencies than millennials or Gen Z. The report suggests that younger investors can learn from boomers' traditional market research methods to make better investment decisions in the crypto space.

The Benefits of Traditional Market Research

According to the report by Bybit and Toluna, boomers spend more time doing due diligence on projects and focus on technical factors, while younger investors prioritize reputational elements. This traditional market research can provide several benefits for investors, including:

- Better understanding of the market: Traditional market research can help investors understand the market and identify potential opportunities for investment.

- Improved decision-making: By conducting thorough research, investors can make more informed decisions and reduce the risk of losses.

- Increased confidence: Knowing that you have done your due diligence can give investors increased confidence in their investment decisions.

How Millennials Can Learn from Boomers

While millennials and Gen Z may prioritize different factors when investing in cryptocurrencies, they can still learn from boomers' traditional market research methods. Some tips for younger investors include:

- Do your due diligence: Take the time to research projects thoroughly and understand the market before investing.

- Focus on technical factors: Consider the technology behind a project and its potential for growth and adoption.

- Diversify your portfolio: Spread your investments across a range of different cryptocurrencies to reduce the risk of losses.

- Seek professional advice: Consider seeking advice from a financial advisor or investment professional before investing.

Overall, while boomers may have an advantage when it comes to investing in cryptocurrencies, younger investors can still learn from their traditional market research methods to make better investment decisions in the crypto space.

Top Cryptocurrencies to Invest in for Boomers

According to gobankingrates.com, there are several cryptocurrencies worth investing in for 2023. While cryptocurrency is mostly treated as a long-term investment, it is important to consider factors such as longevity, track record, technology, and adoption rate when choosing which cryptocurrencies to invest in.

Bitcoin

Bitcoin is the most well-known cryptocurrency and has been around since 2009. According to gobankingrates.com, Bitcoin is a popular choice for investors due to its longevity, high adoption rate, and proven track record.

Ethereum

Ethereum is another popular cryptocurrency that has been around since 2015. According to gobankingrates.com, Ethereum is a strong contender for long-term investment due to its smart contract capabilities, which allow for a range of decentralized applications.

Binance Coin

Binance Coin is the native cryptocurrency of the Binance exchange and has seen significant growth in value over the past few years. According to gobankingrates.com, Binance Coin is a promising investment opportunity due to its high adoption rate and strategic partnerships.

Cardano

Cardano is a blockchain platform that uses the ADA cryptocurrency. According to gobankingrates.com, Cardano is a promising long-term investment due to its focus on sustainability, interoperability, and scalability.

Polygon

Polygon is a Layer 2 scaling solution for Ethereum that aims to improve scalability and reduce transaction fees. According to gobankingrates.com, Polygon is a promising investment opportunity due to its potential for growth and adoption.

Terra

Terra is a blockchain platform that uses stablecoins to facilitate payment and commerce. According to gobankingrates.com, Terra is a strong contender for long-term investment due to its focus on stablecoins, which can reduce the volatility of cryptocurrency investments.

Avalanche

Avalanche is a blockchain platform that aims to improve scalability and reduce transaction fees. According to gobankingrates.com, Avalanche is a promising investment opportunity due to its focus on interoperability and its potential for growth and adoption.

Chainlink

Chainlink is a decentralized oracle network that facilitates secure interactions between blockchains and external data feeds, events, and payment methods. According to gobankingrates.com, Chainlink is a promising long-term investment due to its strategic partnership with Google and its use in the new inflation index from decentralized finance company Truflation. However, like other cryptocurrencies, Chainlink has experienced price volatility and should be considered a high-risk investment.

How to Invest in Cryptocurrencies

Investing in cryptocurrencies can be a daunting task, but with the right knowledge and tools, it can be a lucrative investment opportunity. Here are some steps to get started with investing in cryptocurrencies:

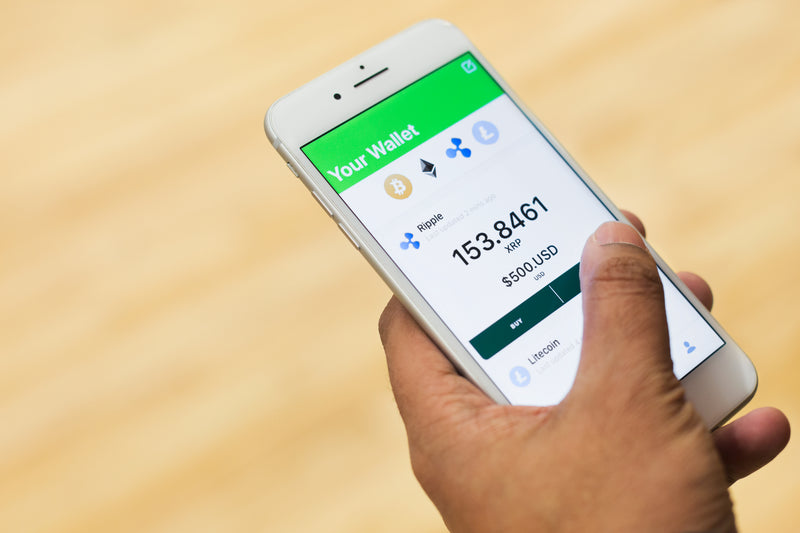

Step 1: Open a Cryptocurrency Wallet

The first step to investing in cryptocurrencies is to open a cryptocurrency wallet, which is a digital wallet that allows you to store, send, and receive cryptocurrencies. There are several types of cryptocurrency wallets, including software wallets, hardware wallets, and online wallets.

Step 2: Choose a Cryptocurrency Exchange

Once you have a cryptocurrency wallet, you will need to choose a cryptocurrency exchange, which is a platform that allows you to buy, sell, and trade cryptocurrencies. Some popular cryptocurrency exchanges include Coinbase, Binance, and Kraken.

Step 3: Fund Your Account

To start investing in cryptocurrencies, you will need to fund your account on the cryptocurrency exchange. This can typically be done using a bank transfer, credit card, or debit card.

Step 4: Choose the Cryptocurrencies to Invest In

Once you have funded your account, you can choose which cryptocurrencies to invest in. It is important to conduct thorough research and consider factors such as longevity, track record, technology, and adoption rate when choosing which cryptocurrencies to invest in.

Step 5: Monitor Your Investments

After investing in cryptocurrencies, it is important to monitor your investments regularly to ensure that they are performing as expected. This may involve monitoring the price of cryptocurrencies, tracking news and developments in the market, and adjusting your investment strategy as needed.

Step 6: Consider Seeking Professional Advice

Investing in cryptocurrencies can be a complex and risky endeavor, and it may be beneficial to seek professional advice from a financial advisor or investment professional before investing. A professional can help you understand the risks and benefits of investing in cryptocurrencies and develop a strategy that aligns with your investment goals.

Risks of Investing in Cryptocurrencies

While investing in cryptocurrencies can be a lucrative opportunity, it is important to be aware of the risks involved. Here are some of the main risks associated with investing in cryptocurrencies:

High Volatility

Cryptocurrencies are known for their high volatility, which means that their value can fluctuate rapidly and unpredictably. This can lead to significant gains or losses for investors, and it is important to be prepared for the possibility of losses.

Lack of Regulation

Cryptocurrencies operate independently of central banks and governments, and they are not subject to the same regulations as traditional financial instruments. This lack of regulation can make cryptocurrencies more vulnerable to fraud, hacking, and other forms of manipulation.

Security Risks

Cryptocurrency wallets and exchanges can be vulnerable to hacking, theft, and other security risks. It is important to take steps to secure your cryptocurrency investments, such as using strong passwords, enabling two-factor authentication, and storing your cryptocurrency in a secure wallet.

Lack of Liquidity

Cryptocurrencies can be less liquid than traditional financial instruments, which means that it may be more difficult to buy or sell them quickly. This can make it harder to exit a position or capitalize on market movements.

Regulatory Changes

Regulatory changes can have a significant impact on the value of cryptocurrencies. For example, government regulations that restrict or ban cryptocurrency trading can lead to a decline in value, while regulations that promote cryptocurrency adoption can lead to an increase in value.

Conclusion

Investing in cryptocurrencies can be a high-risk, high-reward opportunity for investors looking to diversify their portfolios. However, it is important to be aware of the risks involved and to take steps to protect your investments. By conducting thorough research, choosing a reputable exchange, and taking steps to secure your investments, you can minimize the risks associated with investing in cryptocurrencies and potentially reap significant rewards.

Wrapping Up

Investing in cryptocurrencies can be a lucrative opportunity, but it is important to approach it with caution and be aware of the risks involved. By following the steps outlined in this article, you can get started with investing in cryptocurrencies and potentially reap significant rewards.

At ccryptoinvestingforboomers.com, we are committed to providing high-quality resources and information to help boomers navigate the world of cryptocurrency investing. Be sure to check out our other great content for more tips, insights, and strategies for profitable crypto investing.

Remember, investing in cryptocurrencies is a high-risk, high-reward opportunity. It is important to conduct thorough research, choose a reputable exchange, and take steps to secure your investments. With the right knowledge and tools, however, you can potentially generate significant returns and achieve financial freedom through crypto investing.

Questions and Answers

Q. Who can invest in cryptocurrencies?

A. Anyone can invest in cryptocurrencies, including boomers.

Q. What are some benefits of investing in cryptocurrencies?

A. Benefits of investing in cryptocurrencies include potential high returns and portfolio diversification.

Q. How do I choose which cryptocurrencies to invest in?

A. Conduct thorough research and consider factors such as longevity, track record, technology, and adoption rate.

Q. What are some risks associated with investing in cryptocurrencies?

A. Risks include high volatility, lack of regulation, security risks, lack of liquidity, and regulatory changes.

Q. How do I secure my cryptocurrency investments?

A. Use strong passwords, enable two-factor authentication, and store your cryptocurrency in a secure wallet.

Q. What if I'm not comfortable investing in cryptocurrencies?

A. It is important to invest in assets that align with your risk tolerance and investment goals. Consider seeking professional advice.