Table of Contents

Toggle- Practical Crypto Investing for Boomers

- Benefits of Cryptocurrency

- Boomers and Cryptocurrency

- Practical Steps for Boomers to Invest in Cryptocurrency

- Risks of Investing in Cryptocurrency

- Final Thoughts

- FAQs

- Question: Who can invest in cryptocurrency?

- Question: What are the risks of investing in cryptocurrency?

- Question: How can I start investing in cryptocurrency as a boomer?

- Question: What is the best way to diversify my cryptocurrency portfolio?

- Question: How do I protect my cryptocurrency investments from theft or loss?

- Question: What if I'm still unsure about investing in cryptocurrency?

Practical Crypto Investing for Boomers

Cryptocurrency has become a viable investment opportunity for people looking to diversify their portfolio. Boomers, in particular, can benefit from investing in cryptocurrencies as they plan for their retirement. In this article, we will discuss the benefits, risks, and practical steps that boomers can take to invest in cryptocurrency.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank. Unlike traditional currency, cryptocurrencies are decentralized and operate on a blockchain network, making them more secure and transparent.

Why is Crypto Important for Boomers?

Boomers need to plan for their retirement and ensure their financial security. Cryptocurrency provides an opportunity for boomers to diversify their portfolio and invest in a high-reward, high-risk opportunity.

By investing in cryptocurrency, boomers can potentially earn high returns on their investment, which can help them achieve their financial goals. Cryptocurrency can also serve as a hedge against inflation, as the value of cryptocurrencies tends to rise as the value of traditional currency falls.

Moreover, according to Finance Strategists, digital assets like cryptocurrencies are becoming increasingly important in retirement planning as more people accumulate valuable online assets.

In the following sections, we will discuss the benefits and risks of investing in cryptocurrency and provide practical steps that boomers can take to invest in this emerging asset class.

Benefits of Cryptocurrency

Investing in cryptocurrency provides several benefits to boomers, including high returns, diversification of portfolio, and a potential hedge against inflation.

High Returns

According to Finance Strategists, investing in cryptocurrency can provide high returns. For instance, Bitcoin, the first and most popular cryptocurrency, has grown from $0.0008 to over $60,000 per coin in just over a decade.

While the volatility of cryptocurrency prices can be a cause for concern, it can also provide an opportunity for high returns. For instance, Bitcoin experienced an annualized return of 230% from 2011 to 2021, according to Finance Strategists.

Diversification of Portfolio

Investing in cryptocurrency can also diversify a portfolio and reduce risk. Cryptocurrency operates independently of traditional financial markets and can provide a hedge against stock market volatility.

Moreover, according to Investopedia, millennials are more likely to invest in cryptocurrency, with 38% having some kind of investment, according to the 2022 Investopedia Financial Literacy Survey. This suggests that investing in cryptocurrency can be a way to diversify a portfolio and appeal to younger investors.

Cryptocurrency as a Hedge Against Inflation

Cryptocurrency can also serve as a hedge against inflation. Traditional currency loses value over time due to inflation, but the value of cryptocurrencies tends to rise as the value of traditional currency falls. This means that investing in cryptocurrency can help boomers protect their wealth from the effects of inflation.

Comparison of Crypto with Traditional Investments

Stock Market

According to a report by Finance Strategists, the average annual return of the stock market from 1928 to 2021 was 10.2%. In comparison, Bitcoin experienced an annualized return of 230% from 2011 to 2021.

Real Estate

Real estate is another popular investment option. However, real estate requires a significant amount of capital and is often illiquid. In contrast, cryptocurrencies can be bought and sold easily and quickly, making them a more accessible investment option.

In the next section, we will discuss how boomers compare to millennials and Gen Z when it comes to investing in cryptocurrency.

Boomers and Cryptocurrency

Boomers have been traditionally considered to be more risk-averse and less likely to invest in cryptocurrency. However, new research suggests that boomers can be better investors in crypto than millennials or Gen Z.

Baby Boomers vs. Millennials and Gen Z

According to a report by Investopedia, millennials are more likely to invest in cryptocurrency, with 38% having some kind of investment. In contrast, only 6% of boomers invest in digital currencies.

Investing Habits

Boomers tend to have more conservative investing habits, preferring traditional investments such as stocks, bonds, and mutual funds. In contrast, millennials and Gen Z are more willing to take risks and invest in emerging asset classes like cryptocurrency.

Risk Tolerance

Boomers are often considered to be more risk-averse than younger generations. However, according to a report by Bybit and Toluna, new research suggests that boomers are better at investing in cryptocurrencies than millennials or Gen Z. The report suggests that boomers spend more time doing due diligence on projects and focus on technical factors, while younger investors prioritize reputational elements.

New Research Suggests Boomers Make Better Crypto Investors

According to the same report by Bybit and Toluna, boomers can teach younger investors a thing or two about investing in crypto.

Due Diligence

Boomers tend to be more diligent in their research when it comes to investing. According to the report, boomers spend an average of 7.5 hours per week doing research compared to 5.5 hours for younger generations.

Technical Factors vs. Reputation

Boomers tend to focus on technical factors when evaluating a cryptocurrency project, such as whitepapers and technical analysis. In contrast, younger investors prioritize reputational elements, such as social media buzz and endorsements from celebrities.

In the next section, we will discuss practical steps that boomers can take to invest in cryptocurrency.

Practical Steps for Boomers to Invest in Cryptocurrency

Investing in cryptocurrency can be daunting for boomers who are unfamiliar with the technology and the risks involved. However, with the right approach, boomers can take advantage of this emerging asset class to achieve their financial goals.

1. Do Your Research

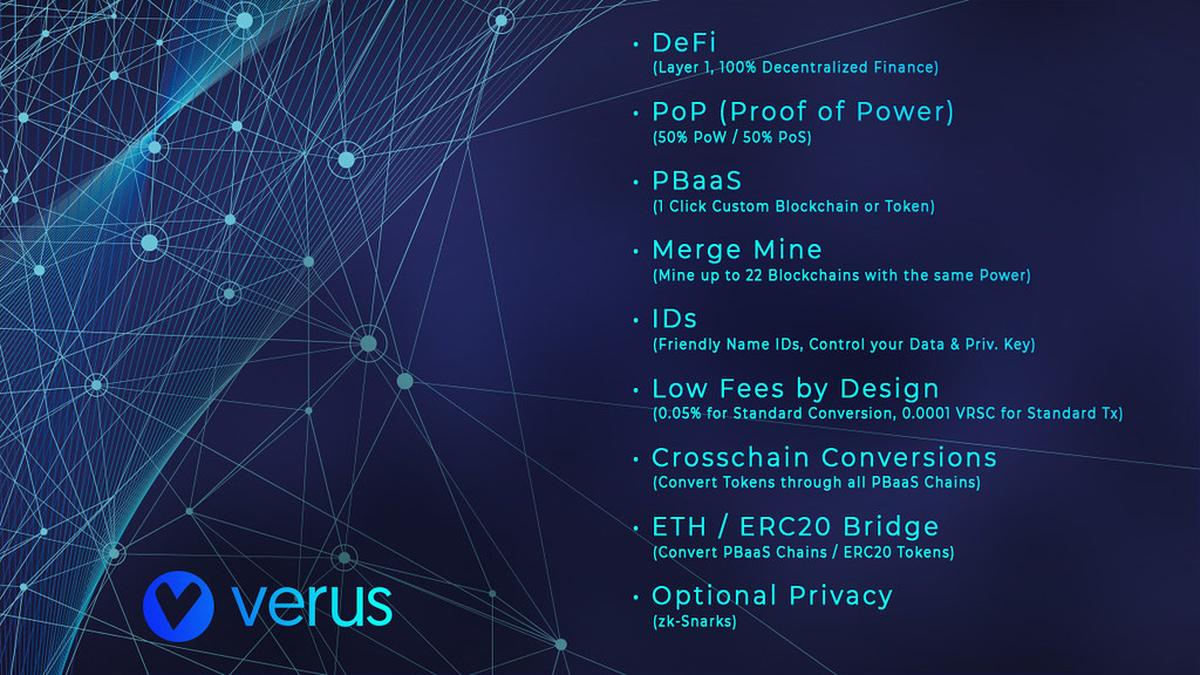

Before investing in any cryptocurrency, it is essential to do your research and understand the technology and the risks involved. Start by researching the top cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, and understand the differences between them.

Technical Analysis

As we discussed earlier, boomers tend to focus on technical factors when evaluating a cryptocurrency project. Technical analysis involves analyzing charts and patterns to predict future price movements and identify potential buying opportunities.

Fundamental Analysis

Fundamental analysis involves evaluating the underlying technology, team, and market demand for a particular cryptocurrency. This can help you identify potential long-term investments.

2. Choose a Reputable Exchange

Once you have done your research and identified the cryptocurrencies you want to invest in, the next step is to choose a reputable exchange to buy and sell them.

Security

Security is crucial when choosing an exchange. Make sure the exchange you choose has a strong track record of security and uses industry-standard security measures, such as two-factor authentication.

Fees

Fees can vary widely between exchanges, so make sure you understand the fees involved before choosing an exchange. Look for exchanges with low trading fees and no hidden charges.

3. Invest What You Can Afford to Lose

Investing in cryptocurrency can be a high-risk, high-reward opportunity. Therefore, it is essential to invest only what you can afford to lose. Do not invest money that you need for your daily living expenses or your retirement.

4. Diversify Your Portfolio

Diversification is key to reducing risk in any investment portfolio. Therefore, it is essential to diversify your cryptocurrency holdings by investing in multiple cryptocurrencies.

5. Stay Informed

The cryptocurrency market is highly volatile and can change rapidly. Therefore, it is essential to stay informed about market trends and news related to your investments. Follow reputable news sources and keep up with the latest developments in the cryptocurrency world.

In the next section, we will discuss the risks involved in investing in cryptocurrency.

Risks of Investing in Cryptocurrency

Investing in cryptocurrency can be a high-risk, high-reward opportunity. While the potential for high returns is attractive, there are also significant risks involved that boomers should be aware of.

Volatility

Cryptocurrency prices are highly volatile and can change rapidly. Prices can fluctuate by hundreds or even thousands of dollars in a single day. Therefore, investing in cryptocurrency requires a high tolerance for risk and the ability to withstand significant price swings.

Security

Cryptocurrency exchanges and wallets can be vulnerable to hacking and cyber attacks. If your cryptocurrency is stolen or lost, it may be challenging or even impossible to recover.

Best Practices for Security

To protect your cryptocurrency investments, it is essential to follow best practices for security, such as:

- Using strong passwords and two-factor authentication

- Keeping your private keys secure and offline

- Using reputable exchanges and wallets

- Regularly backing up your wallet

Regulatory Risks

The regulatory environment for cryptocurrency is still evolving, and new regulations could have a significant impact on the cryptocurrency market. For instance, some countries have banned cryptocurrency altogether, while others have imposed strict regulations that could limit its growth.

Lack of Liquidity

Cryptocurrencies can be illiquid, meaning there may not be enough buyers or sellers to complete a transaction. This can make it challenging to buy or sell cryptocurrency, especially during times of market volatility.

Lack of Transparency

The cryptocurrency market can be opaque, with limited transparency into the underlying technology and market demand. This can make it challenging to evaluate the potential risks and rewards of investing in a particular cryptocurrency.

In conclusion, while investing in cryptocurrency can provide significant opportunities for boomers, it is essential to be aware of the risks involved and invest only what you can afford to lose. By following best practices for security and diversifying your portfolio, you can take advantage of this emerging asset class while minimizing your risk.

Final Thoughts

Investing in cryptocurrency can be a challenging but rewarding experience for boomers. By understanding the risks involved, doing your research, and following best practices for security and diversification, you can take advantage of this emerging asset class to achieve your financial goals.

At ccryptoinvestingforboomers.com, we are committed to providing practical advice and guidance to help boomers invest in cryptocurrency with confidence. Whether you are a seasoned investor or new to the world of cryptocurrency, we have the resources and expertise to help you succeed.

Check out our other great content for more insights and tips on investing in cryptocurrency. Thank you for reading, and happy investing!

FAQs

Question: Who can invest in cryptocurrency?

Answer: Anyone can invest in cryptocurrency, including boomers.

Question: What are the risks of investing in cryptocurrency?

Answer: Risks include volatility, security, regulatory uncertainty, and lack of transparency.

Question: How can I start investing in cryptocurrency as a boomer?

Answer: Start by doing your research, choosing a reputable exchange, and investing only what you can afford to lose.

Question: What is the best way to diversify my cryptocurrency portfolio?

Answer: Diversify by investing in multiple cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin.

Question: How do I protect my cryptocurrency investments from theft or loss?

Answer: Follow best practices for security, such as using strong passwords, two-factor authentication, and keeping your private keys secure and offline.

Question: What if I'm still unsure about investing in cryptocurrency?

Answer: If you are unsure, start small and invest only a small portion of your portfolio. You can also seek advice from a financial advisor.