In a speech given by Federal Reserve Chair Jerome Powell at the Economic Club of New York on October 16, 2023, he reiterated the commitment of himself and his colleagues to achieving a restrictive policy stance in order to bring inflation down to 2 percent and keep it there over time. Powell emphasized the need to keep policy restrictive until they are confident that inflation is on a path to their objective.

Powell acknowledged the recent data showing the resilience of economic growth and demand for labor.[0] However, he also stated that additional evidence of persistently above-trend growth or a labor market that is no longer easing could put progress on inflation at risk and may require further tightening of monetary policy.[1]

The speech also touched on the issue of rising Treasury yields, with Powell stating that if the yields are rising for reasons other than expectations of future rate hikes, it could tighten financial conditions.[2] He emphasized that the Fed's goal is to achieve this tightening of financial conditions.

Powell's speech was closely watched by economists, who were looking for clues on whether the central bank would raise interest rates at its next board meeting in November.[3] Currently, interest rates stand at the highest level in over a decade, and mortgage interest rates in the US have risen to 8 percent.[3] The Fed has paused its rate hike twice this year, and Powell suggested that further pauses can be expected.[3]

He also mentioned the rising political tensions across the world, particularly the recent attack on Israel by Hamas, which he described as “horrifying.”[3]

Powell acknowledged that while there have been a few months of good data, inflation is still too high.[4] He stressed the need to build confidence that inflation is moving down sustainably toward their goal.

He also highlighted the ongoing progress toward the Fed's dual mandate goals of maximum employment and stable prices.[5] However, he noted that there are signs the labor market is gradually cooling, with job openings and wage growth returning to pre-pandemic levels.[6]

In terms of financial conditions, Powell mentioned that they have tightened significantly in recent months, with longer-term bond yields playing a significant role in this tightening.[7] The Fed will remain attentive to these developments as persistent changes in financial conditions can have implications for monetary policy.[0]

Overall, Powell's speech indicated a cautious approach to monetary policy, with the Fed closely monitoring various factors and risks.[8] The market expects the central bank to keep rates unchanged at its next meeting in November.[9]

0. “Fed chair Powell: Hot growth could warrant more rate increases” Axios, 19 Oct. 2023, https://www.axios.com/2023/10/19/federal-reserve-interest-rate-hike-jerome-powell-speech

1. “Fed Monitoring the Economy as Powell Hints at More Rate Hikes” KTBS, 19 Oct. 2023, https://www.ktbs.com/lifestyles/entertainment/fed-monitoring-the-economy-as-powell-hints-at-more-rate-hikes/video_9e15a7c0-f89c-5b4d-9112-cc45698e3177.html

2. “Five-Spot: Benchmark Treasury Yield Flirts with New 1…” The Ticker Tape, 19 Oct. 2023, https://tickertape.tdameritrade.com/market-news/five-spot-benchmark-treasury-yield-flirts-with-new-16-year-high-near-5-as-powell-remarks-awaited-19698

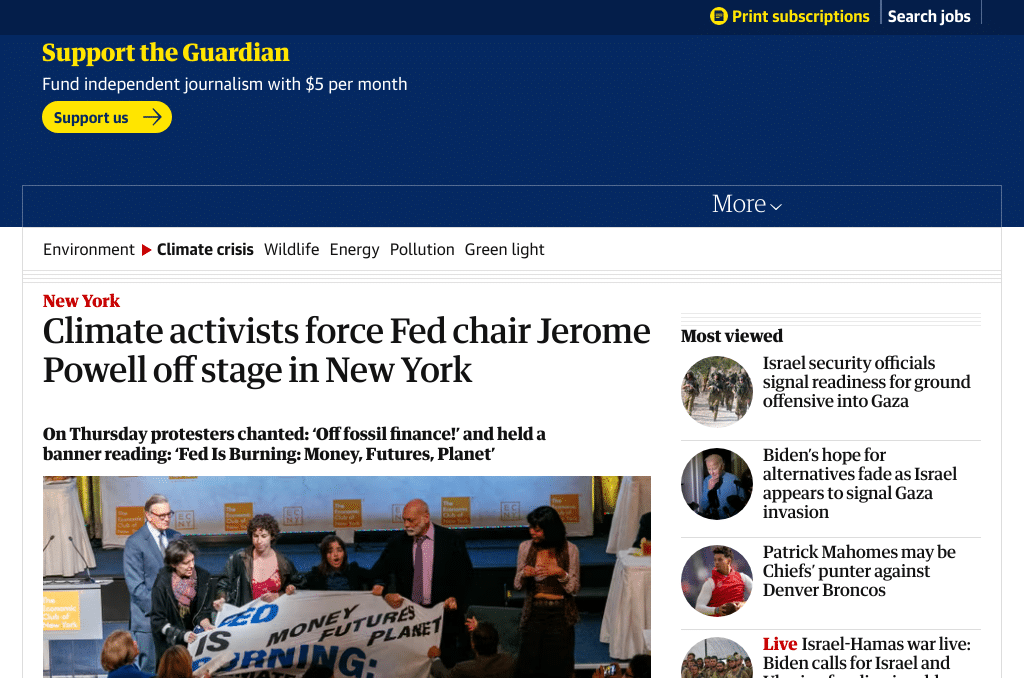

3. “Climate activists force Fed chair Jerome Powell off stage in New York” The Guardian US, 19 Oct. 2023, https://www.theguardian.com/us-news/2023/oct/19/climate-change-protest-fed-chair-jerome-powell-fossil-fuels-new-york

4. “Global uncertainties hamper U.S. efforts to cut inflation to 2%, Fed's Jerome Powell says” UPI News, 19 Oct. 2023, https://www.upi.com/Top_News/US/2023/10/19/Federal-Reserve-Chairman-jerome-powell-interest-rates-discussion-Economic-Club-of-New-York/2971697718489/

5. “Bitcoin, Ethereum, Dogecoin Trade Mixed As Fed's Jerome Powell Warns ‘Inflation Is Still Too High': Analy” Benzinga, 20 Oct. 2023, https://www.benzinga.com/markets/cryptocurrency/23/10/35342324/bitcoin-ethereum-dogecoin-trade-mixed-as-feds-jerome-powell-warns-inflation-is-still-too-h

6. “Fed's Powell Says Inflation Is Still Too High” Newsweek, 19 Oct. 2023, https://www.newsweek.com/feds-powell-says-inflation-still-too-high-1836257

7. “Markets Are Misreading the Fed, and More Rate Hikes Are Possible: Analyst” Markets Insider, 17 Oct. 2023, https://markets.businessinsider.com/news/stocks/fed-rate-hikes-higher-bond-yields-interest-rates-inflation-recession-2023-10

8. “What has today's anxiety meant for the EURUSD, USDJPY and GBPUSD heading into the close” ForexLive, 18 Oct. 2023, https://www.forexlive.com/technical-analysis/what-has-todays-anxiety-meant-for-the-eurusd-usdjpy-and-gbpusd-heading-into-the-close-20231018/

9. “Stock futures slip as 10-year Treasury yield crosses 5% for the first time since 2007: Live updates” CNBC, 20 Oct. 2023, https://www.cnbc.com/2023/10/19/stock-market-today-live-updates.html